Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Get Quick FCRA Registration at Minimal Cost with Legal Pillers

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

The below-mentioned entities are qualified to be eligible for FCRA Registration:

Welcome to Legal Pillers, with us as your partner, FCRA Registration becomes a strategic advantage in your growth, collaboration, and impact. FCRA Registration shows the donation your NGO has received from abroad. It is important when you receive any foreign contribution grants from any registered trust, social institution, or NGO. This act is regulated by The Foreign Contribution Regulation Act, 2010 (FCRA Act). We are committed to the success of your organisation and positive change you want to bring about.

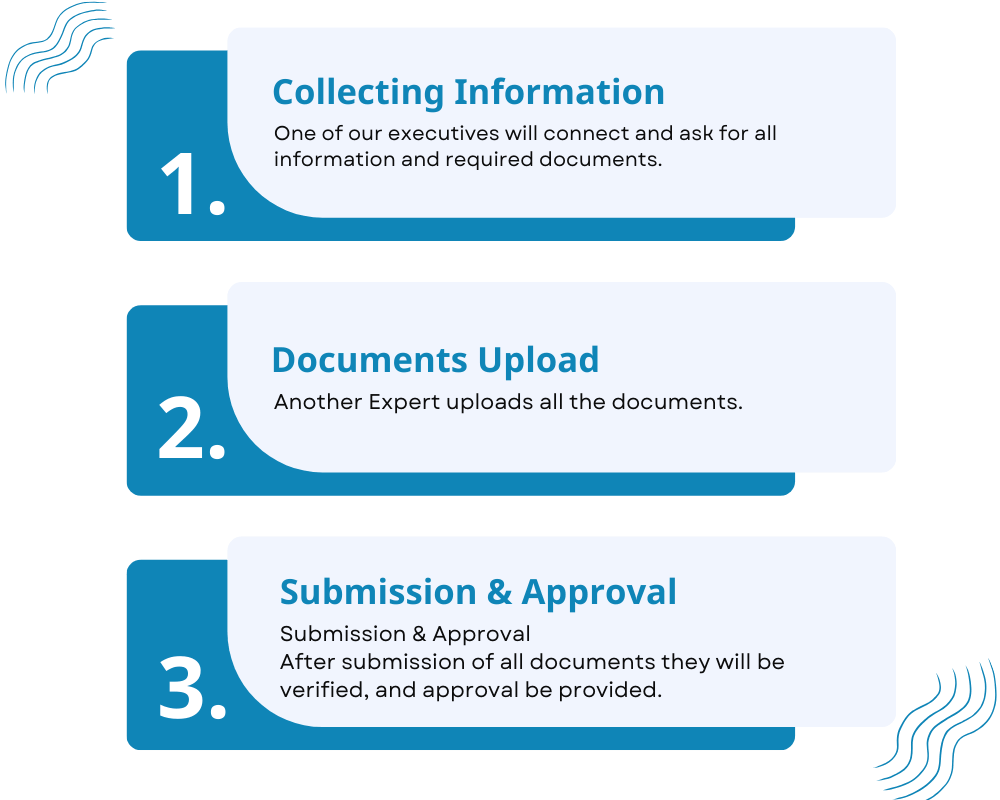

More DetailsWe offer you end-to-end compliance solutions and Liaisoning, so you don't need to go for any other option.

However, a big concern for all entrepreneurs is maintenance cost for registration they are holding. So you will be delighted to know that costing of maintaining an LLP is much lower as compared to others.

After registration, it is not mandatory for you to appoint an Auditor in your LLP as per rules prescribed by government. After reaching certain limit of Turnover have to appoint auditor.

Our team is committed to providing ongoing support, all accessible through our convenient online platform.

It builds trust and credibility among stakeholders, donors, and beneficiaries, growing your organization's reputation.

It enables your organization to have international partnerships, collaborations, and funding opportunities.

FCRA registration empowers your organisation to make a broader impact by engaging in international initiatives and partnerships.

FCRA Registration provides stability and financial security for long-term projects for the betterment of society.

At Legal Pillers we offer you end-to-end compliance solutions and Liaisoning, so you don't need to go for any other option.

Registration provides certain legal protections to the organization and its members, helping to resolve disputes and conflicts within the organization.

Following are the major 15 purposes for which you can receive Donations through FCRA Registration:

More Details| 15 purposes |

|---|

| Children Welfare |

| Rural Development |

| Construction and maintenance of educational institutions. |

| Research. |

| Estb. of Corpus Fund |

| Grant of scholarships, assistance in cash, and kindness to poor/needy |

| Construction/Running of hospital, dispensary & clinic. |

| Non-formal education Providers/coaching classes |

| Orphans welfare |

| Construction/Maintenance of office or other administrative buildings. |

| Construction/Repair/Maintenance of places of worship. |

| Construction/Maintenance of hostel for poor students. |

| Awareness Camp, Seminars Workshops, Meetings & Conference |

| AIDS Awareness / Treatment and rehabilitation of persons affected by AIDS. |

| Maintenance of priests/preachers/ other religious programs |

| Religious schools/education of priests and preachers. |

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

Applying for FCRA registration can be done through the Ministry of Home Affairs (MHA) website or through our experts at Legal Pillers, who guide you through the online application process and provide you with CA services.

The Foreign Contribution (Regulation) Act, 2010 (FCRA) is a crucial legislation in India that regulates the acceptance and utilisation of foreign contributions by NGOs, associations, and institutions.

FCRA registration is the formal process that allows an organisation to legally accept and utilise foreign contributions. It is a mark of transparency and accountability.

An FCRA account is a designated bank account used exclusively for receiving and utilising foreign contributions in compliance with FCRA regulations.

FCRA renewal registration fees can be paid online through the designated online portal the Ministry of Home Affairs provides.

Renewing FCRA registration involves applying to the Ministry of Home Affairs through the designated online portal. Our team at Legal Pillers can assist you in this process.

No, a canceled FCRA registration cannot be renewed. Ensuring compliance and adhering to FCRA regulations is crucial to avoid cancellation.

The status of FCRA renewal can be checked on the Ministry of Home Affairs website by entering the relevant details. Our experts ensure you provide all the updates regarding your FCA renewal process.

The processing time for FCRA renewal varies, but typically, it can take several weeks. Our team ensures a streamlined process to expedite the renewal.

Yes, FCRA renewal is essential to maintain legal compliance and continue to receive foreign contributions.

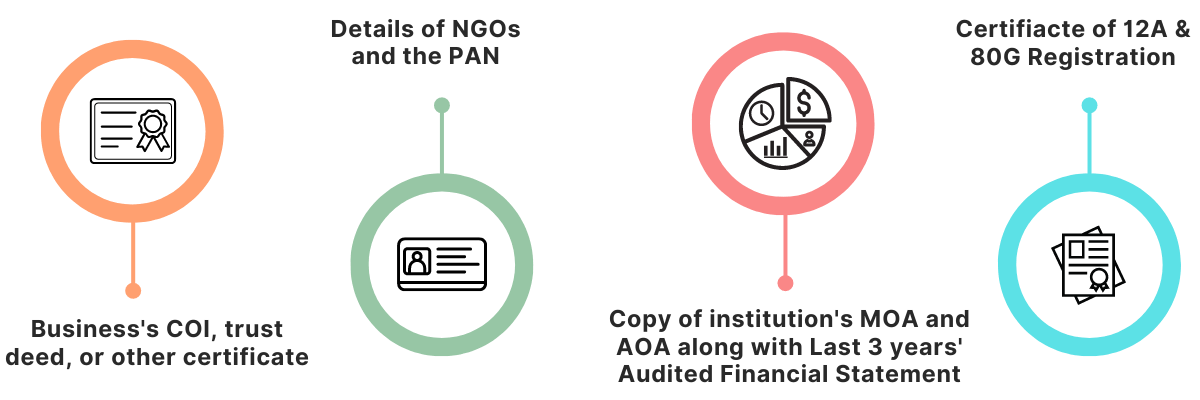

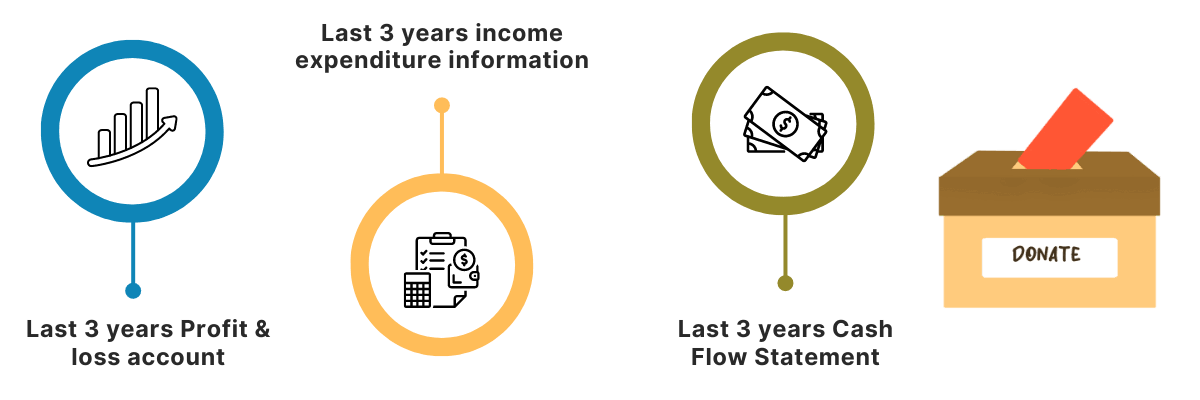

The required documents for FCRA registration include details about the organization, its activities, financial statements, and more. Our experts will guide you through the documentation process.

The Foreign Contribution (Regulation) Act, 2010 (FCRA) is a legal framework enacted by the Government of India to regulate the acceptance and utilisation of foreign contributions.

Examples of FCRA Act regulations include restrictions on using foreign contributions for certain political purposes, the need for prior permission for specific activities, and maintaining transparent financial records.

'Prior Permission' is a mechanism under FCRA that allows organizations to seek permission from the Ministry of Home Affairs for specific activities outside the purview of regular FCRA registration.