Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Get access to Import Export Code License with Legal Pillers in this globalizing world of trade

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

The following are the documents needed for getting IEC Registration in India:

.png?updatedAt=1712059238261)

Following are some entities mandated to apply for IEC Code Registration in India:

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Connect with our Experts and Get personalized Solution.

Book your Call Now

In the dynamic world of international trade, having an IEC is your passport to global markets. The Import Export Code(IEC), is issued by the Directorate General of Foreign Trade (DGFT). It is a requirement for any business looking to engage in import or export activities. Any foreign exchange without IEC License Registration is not permissible in India and is deemed a legal offense. At Legal Pillers, we understand the significance of IEC and offer you a hassle-free online registration process tailored to your business needs. Unlock Global Markets with Seamless IEC Code Online Registration.

More DetailsThe emergency registrations are completed by our expert tax consultants in just one day.

Our CA/CS Experts draft your Import Export License Application and document Evaluation hassle-free.

Our experts complete your registration with minimal documents with proper guidance, making the entire process hassle-free.

Once obtained, an IEC code is valid for a lifetime subject to yearly renewal. And process of renewal is very simple and easy.

Obtain an IEC code to unlock opportunities in international trade and expand your business reach.

Simplify customs clearance procedures, enabling smoother and faster movement of goods across borders.

Establish credibility in the eyes of international partners, boosting your business's reputation.

Avail of various government incentives, schemes, and benefits available exclusively to registered exporters.

IEC is often a prerequisite for selling goods on e-commerce platforms and participating in global marketplaces.

The IEC code is essential for documentation and foreign exchange transactions.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

An Import Export Code (IEC) is a 10-digit identification number required for import or export business activities.

Import Export refers to exchanging goods and services across international borders, involving the buying and selling products between countries.

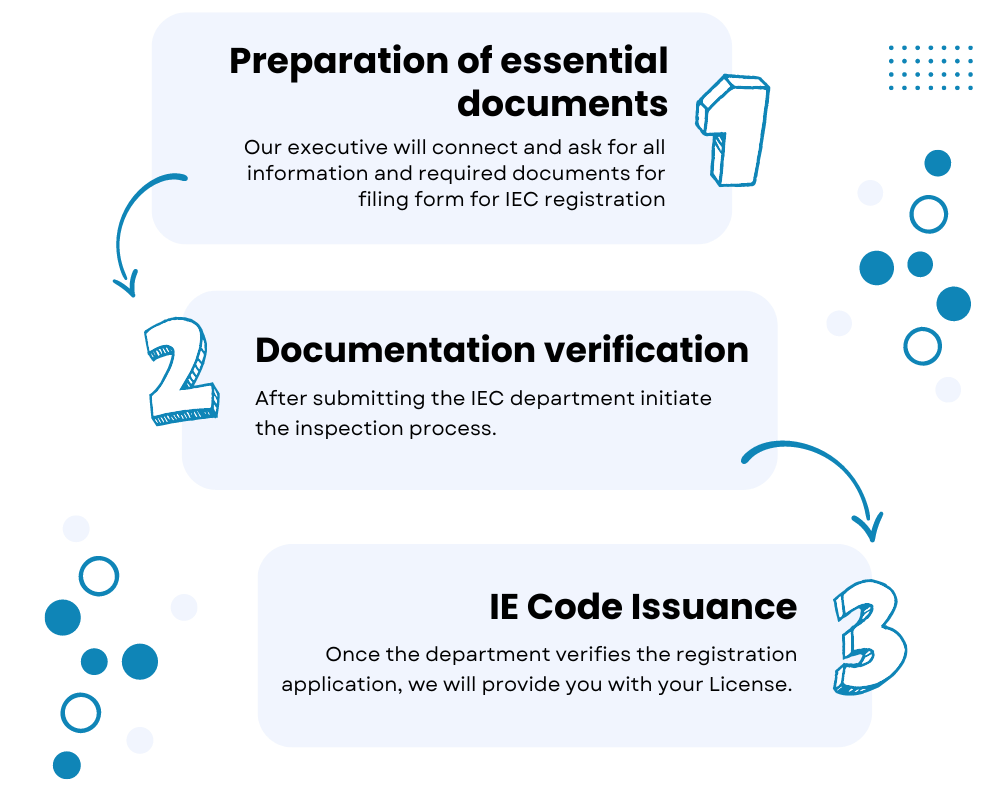

An application must be submitted on the DGFT online portal. This Import Export Code Registration is can through our streamlined online process.

Legal Pillers provides a user-friendly platform for obtaining your Import Export Code registration. Simply follow our step-by-step process.

Any business looking to engage in import or export activities must register for an Import Export Code (IEC) as a mandatory requirement. Importer and exporter Export houses Manufacturer cum exporter Production facilities importing raw material Importer of products that require special authorization from DGFT Entities planning to engage in EXIM business.

IEC registration is necessary to comply with regulatory standards and to facilitate smooth import/export operations, including customs clearance.

You can easily update your Import Export Code online through our platform or DGFT portal. We guide any necessary changes.

To check the customs clearance status of your goods in India, you can use the online portal provided by the customs department.

Custom duty payments can be made through authorized banks or online platforms. Our experts can guide you through the process.

The process for obtaining an import-export license involves acquiring an IEC code. Legal Pillers guide you through this process seamlessly.

Once obtained, an IEC code is valid for a lifetime and does not require renewal.

Individuals and businesses can apply for an IEC code, provided they are engaged in import/export activities.

Yes, you can make necessary modifications to your IEC application. Legal Pillers guides updating your IEC code online.

With Legal Pillers, the IEC registration process is streamlined for efficiency, and you can expect prompt code allocation.