Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Setting up your Dream Venture now became easy with Legal Pillers.

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

Before going for registration of Limited Liability Partnership company, you must have proper idea about its features, which are here as -

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Note: Above charges are excluding gov. fees & other charges.

Talk to our experts to kickstart your business registration process.?

Talk to Registration Experts

Welcome to Legal Pillers, we will help you in identifying why Registration of LLP is Best for you? Limited Liability Partnership registration online is now a popular form of business for the entrepreneurs of India. An LLP includes the features of a Partnership Firm & Private Limited Company. Register a LLP is one of the most suitable types of registration for service providers with low cost maintenance with all major features of a big registrations. With years of expertise, we specialize in Limited Liability Partnership (LLP) registration, ensuring your business operates seamlessly within the legal framework. Our team of CA/CS/ Advocates & Tax Professionals are well-versed in every facet of LLP compliance, ensuring your business meets all regulatory requirements effortlessly.

More DetailsIts Registration is done by Ministry of Corporate Affairs that makes it better registration options amongst other registrations.

However, a big concern for all entrepreneurs is maintenance cost for registration they are holding. So you will be delighted to know that costing of maintaining an LLP is much lower as compared to others.

After registration, it is not mandatory for you to appoint an Auditor in your LLP as per rules prescribed by government. After reaching certain limit of Turnover have to appoint auditor.

Our team is committed to providing ongoing support, ensuring that you remain in compliance with all relevant regulations, all accessible through our convenient online platform.

An LLP is a legal entity from its partners. It can have its own assets, enter into contracts, and sue or be sued in its name and enhanced credibility.

LLP partners are only responsible for what they work in. Each partner is responsible for their own actions and debts, not for the activities of other partners.

Starting an LLP relatively costs less as compare to other registrations. it has lower compliance burden during the year under LLP Act, 2008.

Partners have the freedom to set the terms of their partnership through a partnership agreement, with the roles, responsibilities, and profit-sharing arrangements.

Compared to other registrations, LLPs often have fewer regulatory compliance requirements, making them easier and less expensive to manage.

Registration provides certain legal protections to the organization and its members, helping to resolve disputes and conflicts within the organization.

In accordance with the LLP Act of 2008, after LLP registration online compared to other registration. However these are mandatory in nature and can not skip by LLP. In case you skipped compliance's, there shall late fees prescribed by government. Here is list of compliance which you can go through.

More DetailsEvery LLP holder must file LLP Form 8 in which details of books of accounts & statements of solvency should keep. Form 8 must be certified by the signatures of designated partners. It should be signed by a qualified chartered accountant or practicing company secretary.

LLP must have to file form 11 in which Annual Returns need to file with MCA. This form is a summary of the management activities of LLP. Additionally, form 11 is required to be filed by the 30th of May each year.

LLPs should file their income tax return in Form ITR 5. LLPs that have entered into international transactions with related companies or completed specified Domestic Transactions, must complete Form 3CEB. This form must be certified by a qualified Chartered Accountant.

The Designated Directors need to approve their DIN Allotment through the eForm DIR 3 KYC before September 30th every year. In case any Designated Partner skipped shall be liable to pay a penalty of Rs. 5000/- per director.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

An LLP is a legal entity where the liability of each partner is limited to the extent of their investment in the business. It combines elements of partnerships and corporations.

A partner can be any individual or corporate body. There must be minimum two partners and there is no maximum limit.

No minimum capital requirement for an LLP. Partners can give any amount of capital agreed upon among them.

The steps generally include obtaining a Digital Signature Certificate (DSC) for the partners, obtaining a Designated Partner Identification Number (DPIN), choosing a suitable name for the LLP, preparing the LLP agreement and at last filing the incorporation documents with the Registrar of Companies(RoC).

The registration process typically takes 15-20 working days, but this can vary based on the workload of the relevant government authorities.

Yes, a registered office address in India is mandatory for LLP registration.

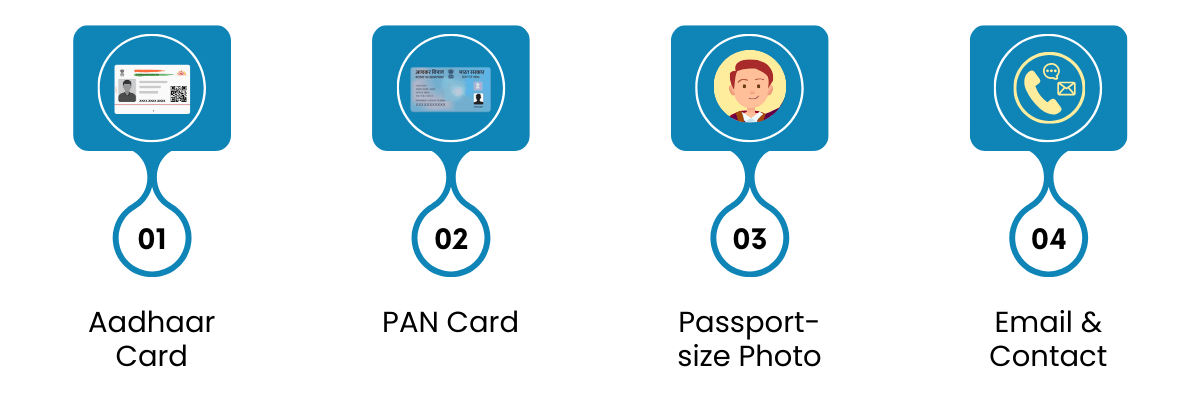

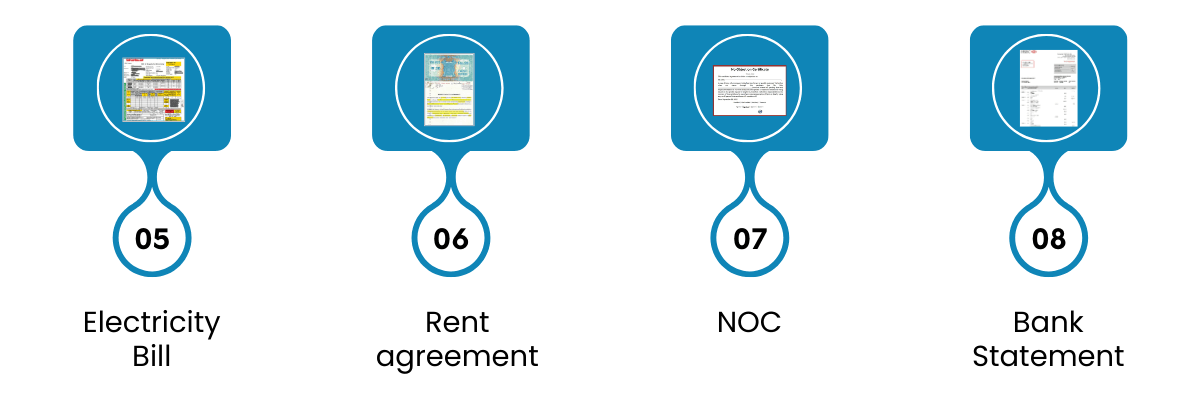

Address proof, identity proof, and PAN card of partners, along with the LLP agreement and registered office details, are typically required documents.

Yes, a CA or CS is required to verify and certify the incorporation documents of the LLP.

Yes, you can convert LLP into a private limited company, subject to compliance with the necessary legal requirements and approvals.

LLPs must file annual returns and account statements with the Registrar of Companies (RoC) within the limited given time.

Yes, an LLP can be closed or dissolved voluntarily by following the procedures outlined in the Limited Liability Partnership Act of 2008.

In many countries, appointing a company secretary for a private limited company is legally required. The secretary is responsible for maintaining company records and ensuring compliance with regulatory requirements.

LLP registration fees is very nominal, you can simply register your LLP in Rs. 6000 to Rs. 7000 only and you will get all registration related documents. We at Legal Pillers, offering this registration at very economical cost.

No, a limited company cannot be a partner in a partnership. A partnership is formed between individuals, and legal entities like limited companies do not have the capacity to enter into such partnerships.

A Limited Liability Partnership (LLP) was first introduced in India in 2008. The Limited Liability Partnership Act, 2008 governs LLPs in India. It is a partnership-based firm founded by at least two partners who signed the LLP agreement. It is considered easy to incorporate because not every partner is liable for any other partner's wrong conduct or carelessness. The rights and obligations of the selected partner are covered in the LLP agreement. They are the sole responsible party to ensure compliance with all provisions of the LLP Act, 2008 and other requirements outlined under LLP Agreement. However, the members of an LLP are not liable for any losses, and the LLP has perpetual succession, just like a private limited company. This registration was executed in India in January 2009 and has been a great success for all professional services and startups. LLP was introduced to offer business benefits such as easy to maintain and assist partners by providing them with limited liability. To register a LLP, one requires connect with Legal Pillers so that they can easily get approval by sitting at their home.

How to select name of LLP?

Select a name that is unique and isn't used by other companies. This will make it easier to get approval and help establish your Company's identity. Use the words that clearly explain the services you offer. This will help people identify the products or services you offer. You must end your LLP name by adding 'LLP' and 'Limited Liability Partnership.' This is essential to display your Company's organizational structure.

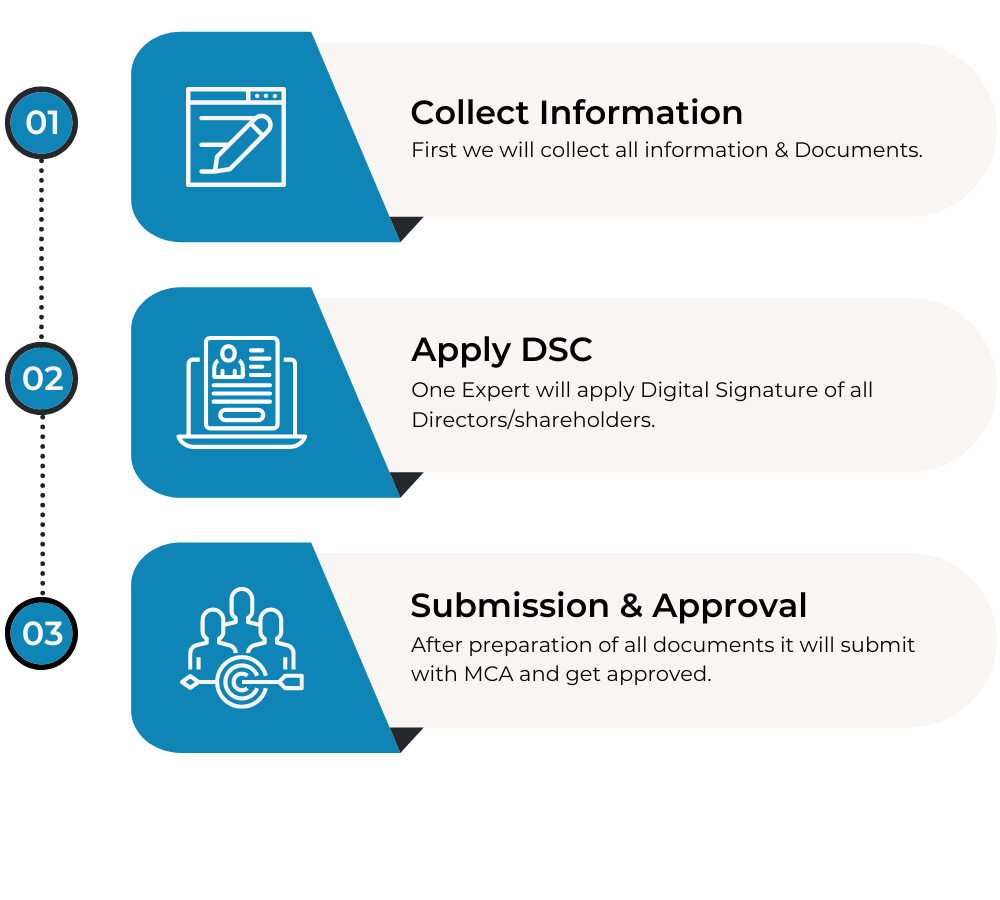

Process to get LLP company Registration

Step 1: Very first have to apply for Digital Signature Certificate (DSC). Government certified authorities are liable to make DSC. We are authorised partners and our DSC specialist will apply DSC of both Designated partners.

Step 2: File for Name Approval: In parallel, we verify if the name you'd like for registration is already in use and then reserve this for the LLP. You can find out about name availability on MCA's portal. The name's approval is granted through the registry only when the central government doesn't consider it to be undesirable.

Step 3: One expert will call you and discuss with your regarding all necessary information and other documents. On the basis of information, he or she will prepare documents to be signed by designated partners.

Step 4: Thereafter, our expert will file application for incorporation of LLP under FiLLiP form with MCA. The recent amendment of 2023 made the changes of applying for PAN, TAN and LLPIN (Limited Liability Partnership Identification Number).

Step 5: Request the Certificate of Incorporation After submitting the application with all the required documents, the Registrar of Companies (ROC) must inspect and confirm the application before issuing a Certificate of Incorporation after verification.

Step 6: Once we will get approval from MCA for LLP Formation thereafter will draft a LLP Agreement. LLP agreement commands the mutual rights and responsibilities among the LLP and its partners. It must be filed within 30 days of the date of incorporation. The user is required to complete Form 3 (information regarding the LLP agreement) on the MCA Portal. The LLP Agreement requires to be printed on Stamp Paper. The value of Stamp Paper varies in every state.

Necessary Forms in LLP Registration

FiLLiP- Formula for incorporation of LLP

Form 2A- Information about designated partners and other partners in LLP

Form 3- Information on LLP agreement

Form 8 - Statement of Solvency and Account

Form 11 - Yearly Returns for Limited Liability Partnership (LLP)

Form 17 - Application and declaration for the transformation of a company into LLP

form 18 - Application and statement to convert a private/unlisted public company into an LLP

Form 24 - Demand to Registrar of Companies for striking off the name of LLP

| Features | Proprietorship | Partnership | LLP | Company |

|---|---|---|---|---|

| Meaning | A business entity that is not registered and controlled by a single individual. | An agreement in writing between at least two parties that allows them to oversee and operate a company | A Limited Liability Partnership is a hybrid with characteristics similar to a partnership company and liabilities identical to those of a corporation. | Registered entity type with restricted liability to its shareholders and the owners. |

| Owner | Sole owner | min 2 person required | Designated Partners | Shareholders: 15 Directors to 200 Directors |

| Requirement of Compliance | Income tax filing for turnover is more than Rs.2.5 lakhs | ITR 5 | Form 8, Form 11, ITR 5 | ITR 6, Auditor?s appointment, MCA filing |

| Transferability | Non Transferable | Transferable if ROF registered | Transferable | Transferable |

| Supporter Liability | Unlimited Liability | Unlimited Liability | Limited Liability | Limited Liability |