Adi Swarup Patnaik

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

Ready to set up your NBFC in Just 7 Days* | Simplest and Fastest Way of Registration.

Customers Served

Project Delivered

Google Rating

10.5k+ Happy Reviews

Before going for registration of Nidhi Company, you must have proper idea about its features, which are here as -

Note:Lorem Ipsum

Note:Lorem Ipsum

Note:Lorem Ipsum

Connect with our Experts and Get personalized Solution.

Book your Call Now

If you are willing to set up a company as a non-bank financial Company, then Nidhi Company Registration Online is the most preferred option. Legal Pillers expert services are prevailing in India. The Nidhi Company Registration in India receives deposits and lends the amount to the members and for the members only. The Company aims to work for mutual benefit and develop the habit of saving among its members. Accepting deposits by Nidhi Limited company is authorized by the Reserve Bank of India (RBI).

Apart from this section, the Companies (Nidhi Companies) Rules of 2014 and Chapter XXVI of the Companies Rules, 2014 also comply with it. This Company has been established under the Ministry of Corporate Affairs. It reserves the right to issue guidelines related to deposit acceptance activities. It cannot do any other business activity except dealing with its members' funds. Accepting deposits by Nidhi Limited company is authorized by the Reserve Bank of India. Nidhi Company raises funds by Recurring deposit (RD) and a fixed deposit from its members. Moreover, it borrows from its members Gold, Shares, RD, FD, Bonds, and Properties.

Its registration is done by the Ministry of Corporate Affairs which makes it a better registration option amongst other registrations.

Nidhi Companies are an attractive option for they are best when it comes to Financing Business.

Nidhi Ltd Registration in India is known as the mini bank as it develops the habit of saving among its members.

It is considered one of the most inexpensive registration similar to NBFC Registration.

Nidhi Ltd registration involves a straightforward process, making it relatively easy to establish and operate.

Due to its non-compliance with RBI, it can regulate its own rules and can function on its own.

Nidhi Companies encourage savings and investment habits among members by providing opportunities for savings and granting loans against shares.

Nidhi Companies enjoy tax benefits under the Income Tax Act, making them an attractive option for those seeking tax advantages.

Members can avail of loans against their deposits, facilitating financial support when needed. This can be particularly beneficial for members who may need access to traditional banking facilities.

The Company can raise funds through member contributions, making it a stable and sustainable source of funding for its operations.

Following are some of the compliance you need to keep in mind while going for a Nidhi Company Registration Online:

More DetailsNeeded for companies incorporated before 19 April 2022. It is a one-time annual statement filed with the ROC in terms of Nidhi Rules. A Nidhi Company must provide the list of its members within 90 days from the close of each fiscal year using this form. If not filed then the company will lose its status with the Central Govt.

It is requested with the MCA for an extension when the Company fails to add 200 members at company incorporation time and maintain Net owned Fund to deposit ratio of 1:20. It must be filed with the Region?s Director within 30 days from the closure of the financial year.

It is a semi-annual return or Half yearly return must also be signed by a practicing chartered professional.

It is used to file to get a Company declaration as a Nidhi Company. It needs to be to be filed within 120 days of Incorporation. Net owned fund should not be less than Rs. 20 Lakh./p>

Form 'AOC-4'Used to attach Profit and Loss Statement/Balance Sheet and other financial statements annually as 'AOC-4'. It must be submitted within 30 days of the AGM, annual general meeting.

A Nidhi Bank must file its Annual Returns by MCA that include ROC by submitting Form 'MGT-7' within 60 days of AG i.e., Annual General Meeting.

Nidhi bank Business, like all other businesses, must file its annual income tax returns at the end of September 30th in the corresponding monetary year.

Customer satisfaction is our major goal. See what our clients are saying about our services.

Startup entrepreneurs can definitely prefer & rely on the services of Legal Pillars for Incorporation of LLP/Companies. Good service by Ms. Sneha Kapoor.

It is really one of the best team, which give lot of respect in dealings and help us at every moment. Thank you legal pillers for helping us at every small steps.

Good work, I am happy with services - Legal Pillers for providing best services for 12A80G in economical prices and in a good speed way. The co-ordination between various team members is also remarkable. Even they all continuously follow up with calls and messages regarding the processes. Also one more good point is all the services are under one umbrella. Special thanks to Shweta, Kalpana, Priya & all the backend team member for execution.

Team Legal Pillers, I am writing to thank you for the quality of service provided by your company. I am sincerely appreciating your efficient, gracious customer service on registering my company. Specially I would like to Thank Ritika who always connected with me and explained in detail while registering company. I would refer my friends to legal Pillers to take best service in low cost.

Very corporative and guides you in a proper way. This was my first time doing online legal services and out of all fear I had it turned out a boon for me. Hope you people keep the services same in future to. For a new startup u can believe them. Thank you once again

We are from Hyderabad, Telangana State. We have taken Services of "Legal Pillers" for New Private Ltd Company Registration. We are extremely satisfied and delighted with their services. They are sincere, experienced and committed. Unquestionable Integrity. Our Interaction was with Ms.Sneha, Mr.Rohit and Ms.Jyostna, excellent team and keeps their word.

Find answers to most popular questions asked to us.

A Nidhi Company is a non-banking financial Company (NBFC) recognized under the Companies Act 2013, primarily deals with accepting deposits and providing loans to its members.

The main objectives of a Nidhi Company are to encourage savings and thrift among its members and to provide loans to them for their mutual benefit.

The requirements for the constitution of a Nidhi Limited corporation include: Members has to be in the range of 2-200. A minimum of 7 members, within 3 members as directors. Each director should have an directors Identification (DIN) number. PAN card copy of directors/shareholders and Passport copy for NRI subscribers.

The minimum capital requirement for a Nidhi Company is Rs. 5 lakh.

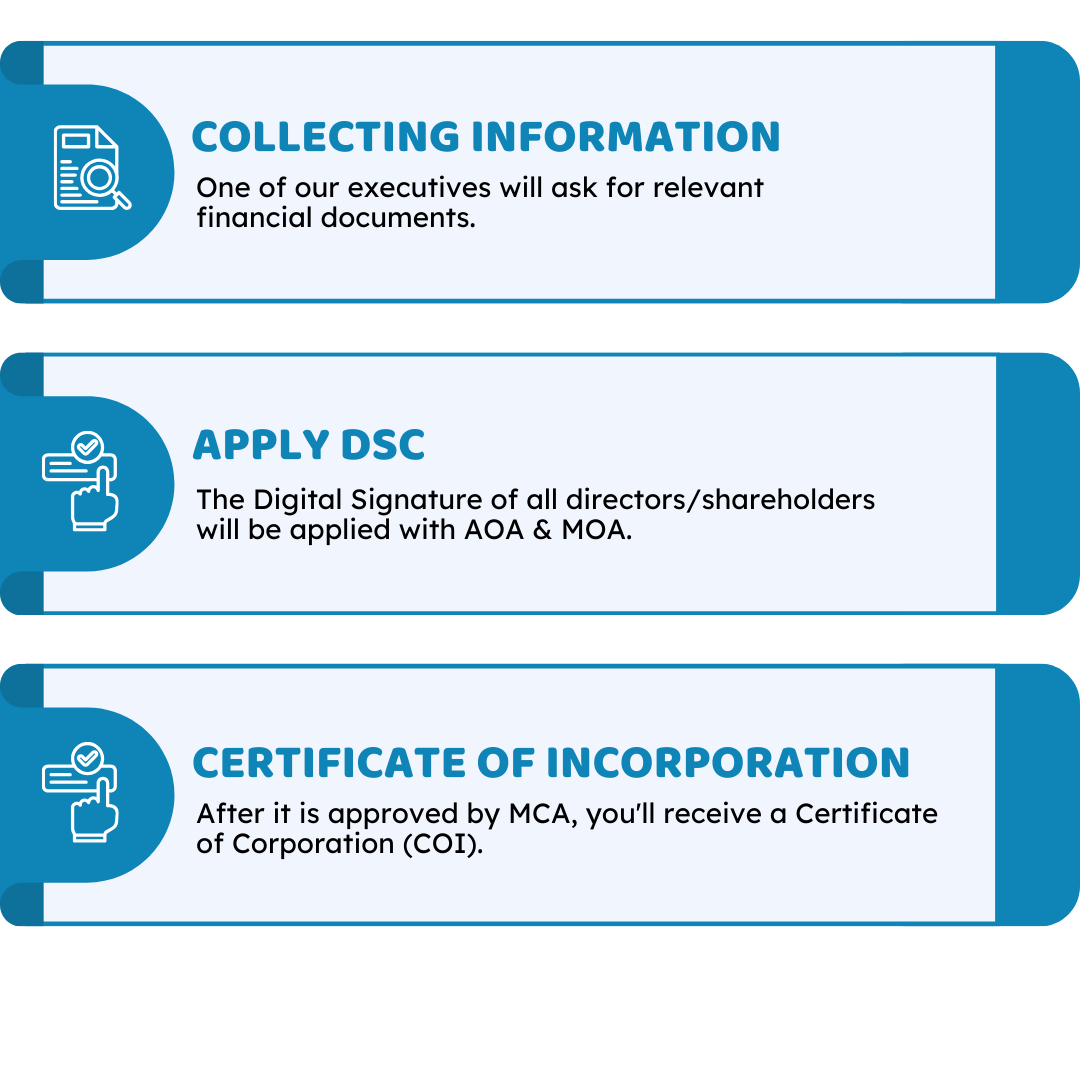

Memorandum of Association (MOA) is defined in Section 2(56) of the Companies Act 2013. It is the basis upon which the firm is constructed. It is the basis for defining the company's constitution, powers and goals of the business. The Articles of Association (AOA) is defined in the section 2(5) of the Companies Act. It outlines all regulations and rules governing the management of the business.

Although SPICe is an electronic form however, SPICe+ is a fully integrated Web form that provides 10 services offered by 3 Central Govt. Ministries and Departments. (Ministry of Corporate Affairs Ministry of Labour & Department of Revenue within the Ministry of Finance) and One State Government (Maharashtra) which will save as many processes, time and costs to start an Business with a business in India. SPICe+ is part of several initiatives and the commitment to government officials of the Government of India towards Ease of Doing Business (EODB). SPICe INC 32 was being completed for incorporation of companies before February 15 2020. For incorporation of all new businesses, the SPICe+ form must be submitted on MCA portal.

You can connect to our Legal Pillers professionals, who can guide you throughout the paperwork process.

No, The Companies (Incorporation) Third Amendment Rules that were adopted on July 27, 2016 has relaxed the obligatory submission of evidence of identity and residency for subscribers with an authentic DIN.

No, a Nidhi Company can only accept deposits from its members, and it should not deal with deposits from the public.

A Nidhi Company can open branches outside its registration district only after obtaining prior approval from the Regional Director.

The minimum share capital requirement varies by country. In some countries, there may not be a specific minimum requirement, while others may have a nominal amount.

In many countries, appointing a company secretary for a private limited company is legally required. The secretary is responsible for maintaining company records and ensuring compliance with regulatory requirements.

Nidhi companies typically have ongoing compliance requirements, including filing annual financial statements, holding annual general meetings, and paying taxes.

Yes, changing the company name after registration is possible, but the process and requirements for name change can vary by jurisdiction.

Nidhi Companies Are Not Permitted to Work with the Following Companies:

Business of Chit Fund, lease finance, hire purchase finance, and purchase of security issued by any corporation.

The issuance of preference shares, debt instruments, or debentures under any name or form Opening Current account.

Acquisitions of another entity through purchasing securities or the control of the BODs of another company in any manner whatsoever.

Incorporating a legal agreement to alter its management structure without a board's approval of a special resolution and consent from the Regional Director in the relevant jurisdiction.

Engaging in activities that are not related to the purpose or the goal of the Company.

Accepting or lending deposits to non-members.

The pledge of assets as members as security.

Making deposits or granting funds to any person from corporate.

Incorporating any partnership agreement to lend or borrow funds.

Making use of any form of advertisement to solicit deposits.

Incentives to pay or for mobilizing deposits from current members or for fund deployment or issuance of loans.

The new rules state that Nidhi Company shall not raise credit from banks, financial institutions, or other sources to finance the members' loans.

Another constraint on buying or acquiring securities, governing any other aspect of the board of Directors of any other company, or signing an agreement to change the management of that Company.

Changes Introduced Through Nidhi Company (Amendment) Rules Of 2022

The following are the changes to registration for Nidhi Company made under the Nidhi Company (Amendment) Rules 2022:

A company cannot increase the amount of deposit required for any member or give loans to any member if:

(i) It is not in compliance with the rules or specifications in Nidhi Company New Rules, (ii) The central government riles are against the application in the form NDH 4.However, nothing stipulated in these rules will apply to a company formed after or on the enactment of the Nidhi Company New Rules.

Any public company that wishes to be registered as a Nidhi company should apply for the form NDH-4 within 120 days beginning from the date of incorporation for the declaration of a Nidhi company once it has met the following requirements:

(i) It has more than 200 members;

(ii) Net-owned funds of at least Rs. 20 lacs and more

After reviewing the application, the central government will communicate its final decision to the Company. If the Company does not do so within 45 days, the application is deemed to have been accepted.However, the Company can begin business only after the central government accepts its application.

The Company will attach a written statement regarding the status of the requirements for a proper and fit person to all its directors and supervisors with the form NDH-4.

The following criteria must be considered in determining whether a Director or promoter is a qualified and correct person:

(a) Integrity, honesty, ethical behavior, integrity, fairness, reputation, and character.

(b) Not committing any of the listed disqualifications as follows:

(i) Any complaints or information relating to the section 154 CrPC is filed or is in the process of being filed against him

(ii) Charge sheet that was filed against him about economic crimes.

(iii) Restrictions, prohibitions, or departmental order was given to him in connection to the Company's law, securities legislation, or financial market force

(iv) Conviction order issued against him that entails moral turpitude

(v) Involvement declared and has not been dismissed

(vi) Unsound mind

(vii) Wilful defaulter

(viii) Economic offender who is fugitive

(ix) Directors of 5 or more companies.

(x) This person should be the Director of at least five Nidhi Companies or promoter in over three Nidhi Companies

The minimum capital for shares that must be paid up has been increased between 5 and 10 lakhs.

Nidhi Company is in existence at the date of the enforcement of Nidhi Company's New Rules and shall comply with the rules within 18 months from the date of enforcement. The requirement to submit the application using Form NDH 1 in the first 90 days after the date of incorporation will not apply to companies that were incorporated before or following the implementation of Nidhi Company New Rules.

The requirement of Net-owned money in the Nidhi business has been modified between 10 and 20 lakhs.

Suppose a Nidhi company plans to open at least three branches in the district or any branch outside the district. In that case, it must fill out Form NDH 2 with the fee required by the Companies (Registration Offices and Fee) Rules, 2014, and inform them about this branch opening with the Registrar within 30 calendar days of the time of opening. But, it can only open branches if it's submitted its financial statements or annual return before the Registrar. Also, it can only establish its branch within the state where its office is registered.

In the Annexure, a modification has been made to the Forms (NDH 2 Form Heading, Serial No. 4 serial number. 6 In NDH 5 (in NDH 3. NDH Also, after NDH 4, a new form of NDH 5 is added.)

| Features | Pvt Ltd | LLP | OPC | Proprietorship |

|---|---|---|---|---|

| Meaning | Private Limited is a company which consider as a normal registration with 2 directors under Companies Act, 2013. | LLP is a newly introduced concept and is a mixture of Pvt Ltd and partnership firm register under LLP Act | OPC is also a type of Pvt Ltd having only one director and shareholder newly introduced by government | Any registration which govern sole ownership business format consider as sole firm registration such as GST, MSME, Shop Act Reg., etc |

| No of Person | Minimum 2 person required | min 2 person required | only one person required | only one person required |

| Liability | no liability on members | no liability on partners | no liability on member | personal liability of individual |

| Minimum Capital | Not required | Not required | Not required | Not required |

| Compliance | Applicable as per Companies Act 2013 | Applicable as per LLP Act | Applicable as per Companies Act 2013 | Not Mandatory |